What just happened?

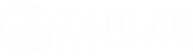

Mortgage News Daily’s daily index printed 6.55 % for the 30-year fixed this morning(Mortgage News Daily)—and many lenders repriced as low as 6.52 % by midday, the cheapest financing we’ve seen since last October.

Other trackers echo the move:

Freddie Mac’s weekly survey (8/7) shows 6.63 %, its third straight weekly decline(Mortgage News Daily).

Why are rates falling?

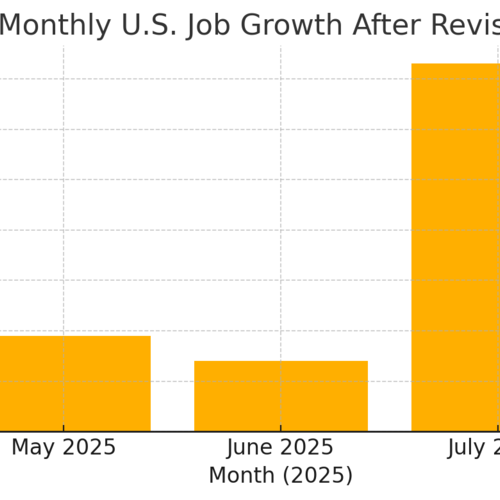

Cooler economic data. July payroll growth missed forecasts and prior months were revised down, trimming inflation fears.

Bond-market rally. Money flowed into 10-year Treasuries, pushing yields—and therefore mortgage rates—lower.

Shift in Fed expectations. Futures markets now see slim odds of another 2025 rate hike, easing upward pressure on long-term borrowing costs.

The Las Vegas angle

| Snapshot | The takeaway |

|---|---|

| Valley-wide median price (June): $485,000(Las Vegas Review-Journal) | Prices are back at record highs, but inventory has surged ≈7,000 active listings, up 70 % YoY, giving buyers leverage. |

| Summerlin West median price (June): $832,000 | Luxury buyers gain ~$250–$300/mo in payment relief at 6.52 %, widening the pool for high-end listings. |

| Henderson median price (June): $500,000 | Still affordable relative to Summerlin; the new rate could flip borderline renters into first-time buyers. |

| Rate slide: 7.00 % → 6.52 % | On a $450 k loan that shaves ≈$145/mo (≈$1,740/yr) off the payment—real money for PITI budgets. |

How today’s lower rates help buyers

More home for the same payment. That $145/month cut boosts purchasing power by roughly 5-10 %, depending on down payment.

Better qualifying math. Lower payments tighten debt-to-income ratios—often the last hurdle for FHA and VA borrowers eyeing Henderson starter homes.

Seasonal sweet spot. Late-summer traffic in Summerlin, Green Valley and Inspirada is calmer than spring; pairing that lull with cheaper financing can be a winning combo.

How lower rates help sellers

Bigger buyer pool. Every 0.25-point dip brings thousands of fence-sitters back to our search sites (Search Homes)

Stronger offers. When payments pencil out more comfortably, buyers in Summerlin South or Anthem are less likely to demand concessions.

Faster timelines. Inventory is high, but well-priced homes in Henderson’s 89052 ZIP and Summerlin’s Paseos Village could see “days on market” shrink if rates hover in the mid-6s.

Bottom-line advice

Buyers: Lock a rate while the 6.5 % handle lasts; it can vanish with one hot CPI print.

Sellers: If you’re eyeing a fall listing in Summerlin or Henderson, consider sliding the date forward to ride today’s bump in affordability.

Still deciding? I can run a custom payment scenario, valuation, or both—no strings attached.