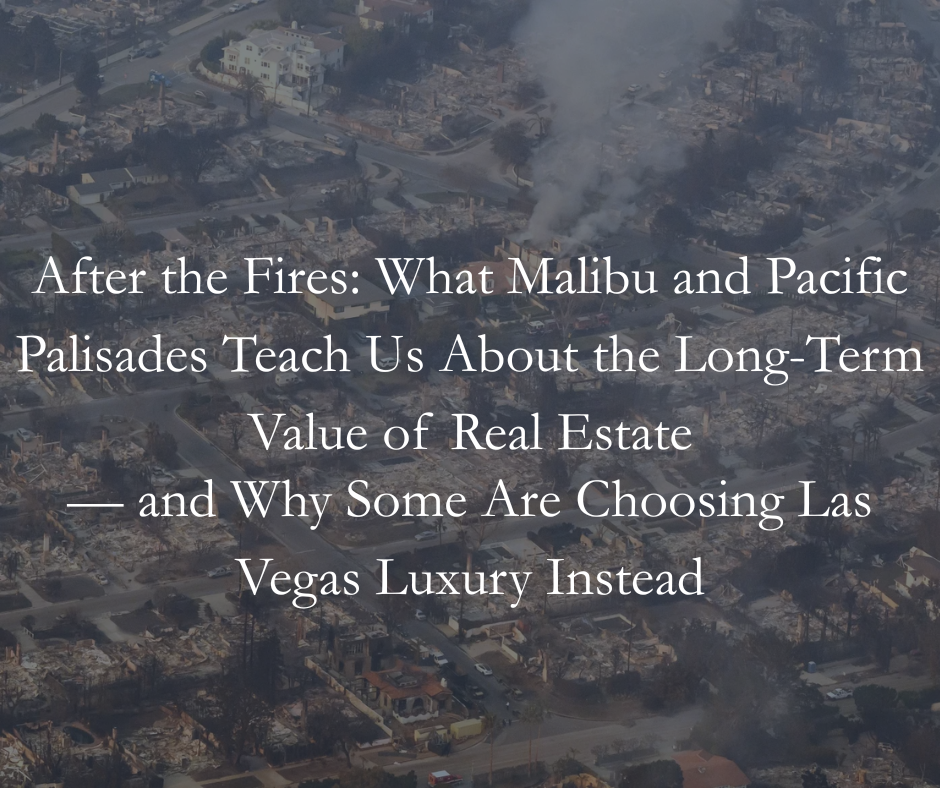

Growing up in the Pacific Palisades, the canyons, coastline, and close-knit community weren’t just where I lived — they were part of who I was. From afternoons at Palisades Park playing basketball to winding drives up Temescal Canyon and Chautauqua, every corner held a memory.

Today, in the wake of the devastating January wildfires, it’s hard not to wonder: what will the Palisades I knew become? And will it still feel like the place that shaped so many of my early years?

Resilience in the Face of Loss

The recent fires across Malibu and the Palisades were catastrophic — hundreds of homes destroyed, entire streets reduced to ash. Yet, in a twist that only high-demand coastal real estate can produce, some of the land is now selling for record numbers.

A foreign investor recently spent over $65 million acquiring nine oceanfront lots in Malibu’s La Costa Beach — parcels where the homes had been completely lost (New York Post). Despite two-year (if they're lucky) rebuild timelines, strict environmental oversight, and costly insurance requirements, the buyer clearly sees enduring value. And don't get this twisted, the buyer fully intends to build in order to sell - at a profit - meaning they view the upside as substantially higher values.

It’s not an isolated case. Vacant Malibu lots — some no larger than a suburban yard — are listed for $2.75 million or more (Business Insider), proving that in prime coastal zones, demand rarely disappears — it simply shifts.

Pacific Palisades: Shaken, But Holding Value

In the Palisades, the market is showing remarkable resilience. While “Million Dollar Listing” star Josh Altman estimates that up to 70% of displaced residents may not return due to underinsurance, rebuilding fatigue, and rising costs (New York Post), the land itself remains highly sought after. Heck, even people I know, really, really, really, really well are listing their lots for sale (shameless plug) (Zillow).

In neighborhoods like the Riviera, values have held steady or even appreciated by 10–15% in recent months, a testament to scarcity and enduring lifestyle appeal.

Why Real Estate Endures in the Long Run

This resilience isn’t blind optimism. It’s built on fundamentals that apply to every blue-chip market:

Finite Supply – You can’t make more coastline or hillside view lots. Quite simply, the Palisades will never be larger than it already is.

Global Demand – These areas attract buyers from across the world. Say what you will about the traffic and cost of living, on many days, this place is as close to Paradise as you can imagine.

Lifestyle Value – The climate, scenery, and prestige can’t be replicated elsewhere, not even here in Summerlin.

Rebuilding as Investment – New construction often yields higher values, meeting modern codes and luxury standards.

The Emotional Layer

As a real estate broker today, I evaluate these markets with an analytical lens. But as someone who grew up in the Palisades, I also see the emotional cost. Generational homes... lost. People's entire net worth that was in their homes, gone in the smoke and ash.

The Palisades I knew was full of charming mid-century homes, local diners, and streets where neighbors knew each other by name. With every multimillion-dollar rebuild, some of that character risks being replaced by sleek, ultra-modern estates. The market will adapt — and values will likely rise — but the community’s soul may shift in the process.

For Some, the Path Leads Elsewhere — Including Las Vegas

Not every homeowner wants, or is able, to endure the years-long process of rebuilding in a fire zone. For many, that has sparked a search for turnkey luxury living in safer, tax-advantaged, and lifestyle-rich markets — and Las Vegas luxury real estate has emerged as a prime destination.

High-end neighborhoods in Summerlin, including The Ridges Las Vegas, Red Rock Country Club, Summit Club, and the new builds in Summerlin West, offer many of the same luxuries buyers value:

Gated privacy and security

Custom architectural design and resort-level amenities

Panoramic mountain, golf course, and city skyline views

Year-round sunshine and abundant recreation

The difference? In Las Vegas, there’s no multi-year rebuild timeline, no coastal permitting gridlock, and no wildfire insurance crisis. Buyers can move in, settle, and start enjoying their new lifestyle immediately — often at a fraction of the cost per square foot compared to rebuilding on the coast.

The Takeaway

The fires in Malibu and the Pacific Palisades show us that:

Prime real estate is resilient, even after devastation.

Scarcity drives demand, regardless of short-term challenges.

Relocation patterns matter — and feeder markets like Las Vegas benefit.

Luxury can be redefined — moving inland doesn’t mean compromising lifestyle.

The Palisades of my childhood may never return exactly as I remember it. But the allure of coastal California will remain — and for those ready to turn the page without waiting years to rebuild, luxury communities in Summerlin and across Las Vegas offer a compelling, ready-now alternative.

- Geoff Zahler | Zahler Properties

Sources:

New York Post – Foreign investor spends $65M on Malibu fire-ravaged lots

Business Insider – Malibu oceanfront lots listed for millions after fires

New York Post – Josh Altman predicts 70% of Palisades residents won’t return