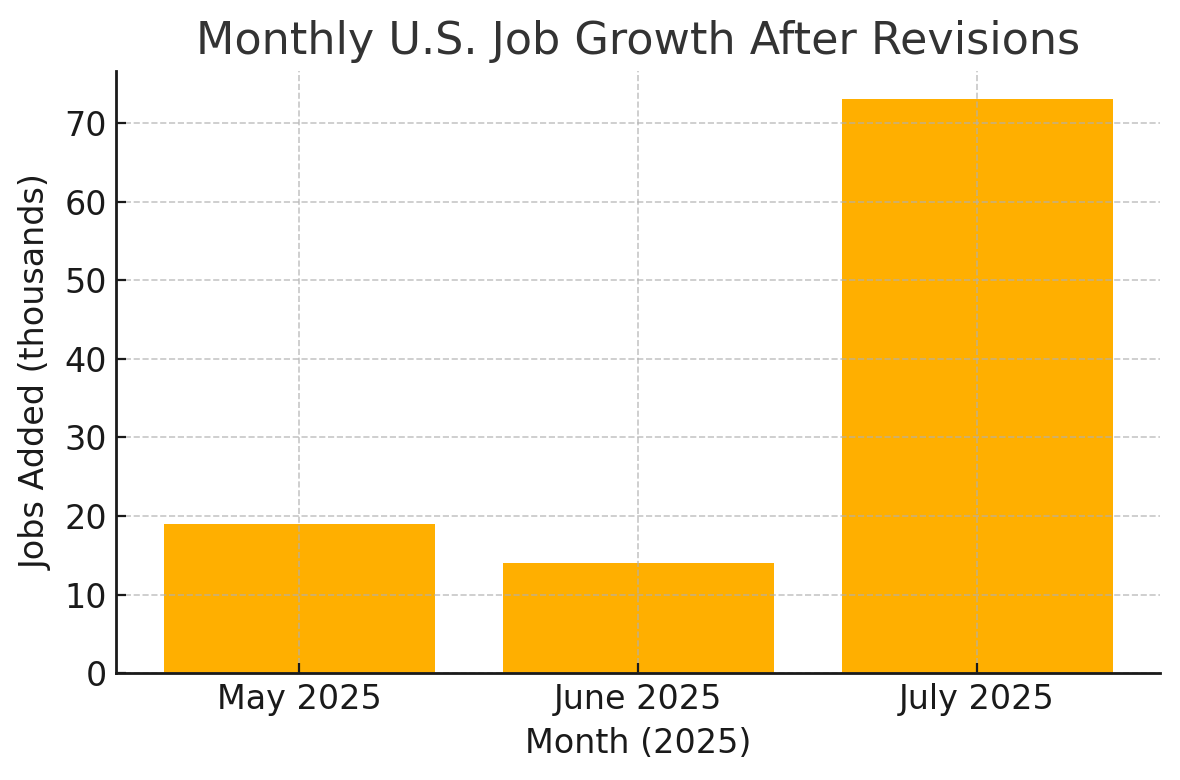

(Check out the bar chart above for a quick visual of how May-July hiring really looks after the huge revisions.)

1. The latest jobs news—quick and clear

- July added just 73,000 jobs, and the unemployment rate nudged up to 4.2 %.

- May and June were overstated by 258,000 jobs; after the cleanup, May shows only 19k new positions and June just 14k. (Reuters)

- Payrolls for May alone were trimmed by 125k—one of the biggest single-month corrections in years. (Reuters)

Why do the numbers swing so much?

The Bureau of Labor Statistics gets extra employer surveys after the first Friday release, then reruns its seasonal-adjustment math. It revises each month twice for exactly this reason. (Bureau of Labor Statistics)

2. What we’re seeing in Las Vegas right now

| June snapshot (Las Vegas Realtors) | Level | Year-over-year | What it shows |

|---|---|---|---|

| Median single-family price | $485,000 | +2.1 % | Prices have plateaued at a record high. (Las Vegas Review-Journal) |

| Homes for sale (no offers) | 6,992 | +70 % | Inventory has doubled—buyers finally have choices. (Las Vegas Review-Journal) |

| Closings (homes + condos) | 2,461 | -7 % (homes) | Demand was cooling before the weak jobs print. (Las Vegas Review-Journal) |

My read: More listings and a softer national labor picture mean sellers need to price realistically, while buyers can shop with a bit more confidence—and possibly with a lower rate soon.

3. Mortgage-rate watch

- National 30-year fixed average: 6.63 % as of August 1. (Mortgage News Daily)

- Bond traders took the jobs miss as a green light, pushing Treasury yields lower and putting a September Fed rate cut back on the table. (Reuters)

What a 0.25 % Fed cut could do here:

On a typical $388k loan (80 % of our median price), shaving even a quarter-point would drop the monthly payment roughly $95-$110—just enough to pull some fence-sitters back into the market.

4. How I’m advising clients this month

| Group | Game-plan |

|---|---|

| Sellers | List competitively and freshen your marketing. Higher inventory plus “soft jobs” headlines mean buyers have leverage if a home is overpriced. Or, you won't get showings! |

| Buyers | Get your pre-approval updated now and ask your lender about float-down options so you can lock in quickly if rates slip after the Fed meeting. |

| Investors | Look at listings that have sat 60+ days in the $600-900 k bracket—motivation is rising just as financing may get cheaper. |

| Fellow agents | Use the simple story—jobs slowing, rates likely easing—to re-engage cold leads and emphasize the importance of updated loan approvals. |

Bottom line

The headline: Hiring is slowing, revisions were huge, and markets smell a Fed cut.

For Las Vegas that likely means slightly lower mortgage rates meeting a market with the most inventory we’ve seen in years. If you’re thinking of buying or selling before the holidays, the next 60-90 days could offer the best mix of rate relief and selection we’ve had all year.

-GZ